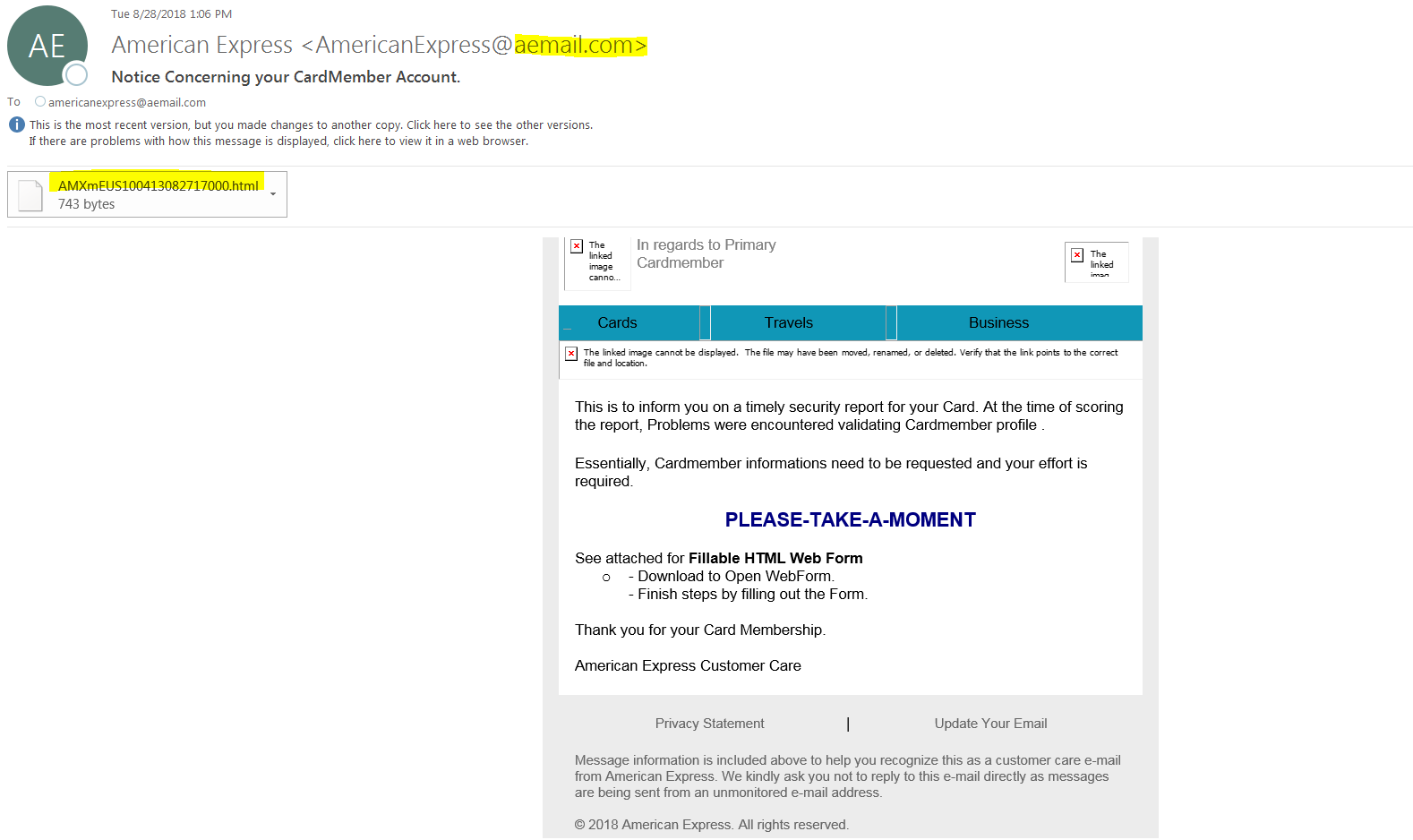

Scam emails have been around as long as the internet. Money-laundering schemes, prime lakefront property in the desert and identity theft scams find their way into our inboxes in many forms. With the bulk of our information managed and stored in the cloud, these emails get more and more sophisticated. So, how can the average person determine what is real and what is trying to bilk what hard-earned dime they have left? Here is a live example, fresh from our own inbox, to demonstrate what to look for and avoid.

If you are not an American Express customer, you may just delete the email. But, if you are a previous victim of identity theft or a cautious consumer, you may be tempted to open the attachment or click on the links in the email. We can’t stress how bad an idea that is, even if you just want to be sure your identity is safe. Instead, use the following tips to keep your identity and your computer safe.

- Use logic. Technology isn’t foolproof and even large companies can send out a badly formatted email from time to time. However, it isn’t often you will find multiple issues such as broken images and links in the same email. Go with your gut. If it looks off, it probably is.

- Verify who the email is actually from. This email was sent from “aemail.com”. If you are a customer, you can compare that to the emails you have received. No match? No problem. Just delete it. You can also go to Google, type the domain in quotes and click search. Aemail.com comes back as an email hiding service that allows the user to hide/mask their real address and domain. Legit? Definitely not!

- NEVER click on a link or open an attachment in a suspect email. Card companies will never have you validate any information by sending an attachment. If there is fraud on an account you have, the company will send you an email, snail mail or call with instructions on how to secure your account.

- Still unsure? Concerned about identity theft? Call the company by going to their website, clicking on “contact us” located at the upper right or bottom left of most pages, and explain your concern to the customer service representative (never google a support number). You may be transferred to their fraud department who can address your issue. Or, check your credit report with a free service like Credit Karma or enroll in Equifax’s Trusted ID. Each will provide you with notices when/if your accounts are compromised or your credit changes. Equifax also provides a free 90-day Fraud Alert that allows creditor access to your report only after verifying your information and a freeze that stops all access to your report. They will even notify the other two credit bureaus for you.

Not all scam emails look the same or have the same purpose. When in doubt, contact us. We will be happy to help!